US & Asia-Pacific +1 800 764 0366 | Europe & Middle East +44 (0)115 980 3800

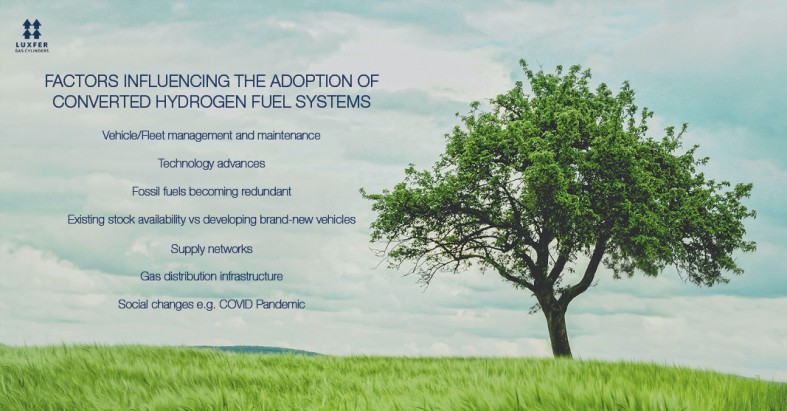

Despite the huge leaps in commitment for hydrogen as a route to decarbonise transport, hurdles to adoption of the technology remain.

Here, Jim Gregory, Business Development Director at Luxfer Gas Cylinders, examines the challenges to scale up an entire industry, incrementally, across many unconnected markets – and how conversion projects hold exciting potential.

A first step in hydrogen adoption

Putting hydrogen vehicles on the road has been led by bus manufacturers, with less widespread availability of hydrogen-powered trucks, boats or trains from the big manufacturers, which can be purchased off the shelf. This means that in these early stages of hydrogen adoption, the first step for many is converting vehicles.

We’re seeing a huge demand for our expertise on conversion projects – a twenty-fold increase in around two years. In addition, the ratio of our design and engineering resource to conversions versus new build hydrogen systems is around 50/50, and we believe this is unlikely to reduce over the next few years.

Nurturing the conversion curve

Fundamental to the hydrogen economy is a gas distribution and supply network that can cope with gradually increasing demand, without being overwhelmed. Conversions support this process because small operators are working with trailblazing companies on projects that will come to fruition very soon – this year onwards.

A focus of growth is captive distribution and logistics fleets. This reflects the increased demand for home deliveries, as a result of the pandemic. The world has changed, and national distribution networks have had to make way for companies based regionally with vehicles that return to the same local depot each day.

Through retrofitting, operators who feel that hydrogen will be important can convert a pilot fleet based upon ten or 12 vehicles a time, for example. They can then build their capacity annually, slowly, commissioning forward-thinking SMEs to do the work.

The benefits of this approach are:

- Within a few years the operators that convert will know how to manage a hydrogen-powered fleet.

- Operators will have developed the supply chain they need for the fuel.

- This model will provide a steady ramp-up of production and distribution that doesn’t outstrip the capacity in any one part of the supply chain, offering a better solution for the industry in its entirety.

- Waiting years for new vehicles to come to market will consume the time that remains before all petrol and diesel must go. This presents operators with a requirement to completely replace their fleets in a very short window, concurrently needing to learn how to operate them.

- It avoids a huge investment from operators to replace thousands of vehicles all at once.

In summary, projects to convert pockets of existing stock allows companies to build up their fleets, ensure their operations remain profitable, develop their knowledge and maximise the return on the capital that they already have tied up in existing higher emissions vehicles.

Disruptive SMEs who are getting stuck into delivering conversions of around ten or 12 vehicles – working beside knowledgeable partners – will provide a favourable environment for the hydrogen economy to thrive.

The role of SMEs

A major driving force behind conversions are SMEs, because such projects allow forward-thinking enterprises to advance more quickly than larger OEMs.

SMEs naturally benefit from being more agile and it’s possible for them to convert battery electric or diesel engines to hydrogen relatively quickly, learning as they go and bringing a product to market faster.

An SME is unlikely to have the capital required to develop a hydrogen road vehicle from scratch, and therefore retrofitting is a viable option that gives the opportunity to get involved. They can make real headway and innovate through retrofitting.

This approach paves the way for the ‘Elon Musks of hydrogen’, to give big truck, bus and car makers a challenge. After all, it could take a major manufacturer three years to have a prototype hydrogen vehicle on the road. Luxfer is working with SMEs who can do this within just six months.

Extracting value from capital investment

Some companies need to look to retrofitting in order to root out value from vehicles that were built with a life expectancy that has been drastically reduced by targets to purge the transport network of diesel by 2040.

Trains and the marine industry among the most affected by this. The initial outlay for a new train is extremely high. New trains would be expected to operate for 25 years and then be re-certified for a further 15 years. Thousands of trains were purchased from 2015 onwards and these operators will find it hard to justify abandoning them for a hydrogen version. Those trains could have 30 years more service capability – and therefore converting rail stock to hydrogen is cost effective.

Similarly, marine vessels are high-cost and can operate for decades – making conversion to hydrogen power appealing.

The era for conversions

We’re seeing demand rise exponentially across Europe and within all transport sectors, from boats, trains, planes, refuse trucks, mechanical handling, vans, refrigerated vans, light trucks, cars and more.

Although Europe and Asia are leading the way, other regions are joining, and we’re involved in many projects in Australia, New Zealand, and North and South America.

Investment is being made from private organisations as well as governments, highlighting that this is the era for conversions. This is particularly relevant for captive fleets such as the regional delivery networks, supermarket vans and even tug boats that operate around international ports.

Projects are being turned around in as little as six months and this will be the year when the public will see hydrogen vehicles on UK roads – most likely beginning in Scotland with refuse trucks and utility vehicles.

A cost-efficient solution

Some companies will be required to opt for conversion because they need to extract value from vehicles that were built with a life expectancy that has been slashed by targets to rid the transport network of diesel by 2040.

The impact of this is sector-specific, with trains and the marine industry among the most affected. The initial outlay is extremely high for a newly built train, which would be expected to operate for 25 years and then be re-certified for a further 15 years of service. Operators who procured a train in the last decade – and thousands were purchased from 2015 onwards – will find it hard to justify scrapping it for a hydrogen version. Those trains could have 30 years more good service in them – so converting rail stock to hydrogen becomes cost effective.

Likewise, marine vessels are high-cost units that can operate for decades – making conversion to hydrogen power most appealing.

A growing global appetite for hydrogen retrofits

At Luxfer we’re seeing demand rise exponentially across Europe and within all transport sectors, from boats, trains, planes, refuse trucks, mechanical handling, vans, refrigerated vans, light trucks, cars – the list goes on.

Although Europe and Asia are leading the charge in every direction, other regions are catching up. Luxfer is involved in many projects in Australia, New Zealand, and North and South America.

Investment is being secured from private organisations as well as governments, underpinning that this is the era for conversions. This is especially true when it comes to captive fleets such as the regional delivery networks, supermarket vans and even tug boats that operate around international ports.

Collaborating on conversions and cross-fertilisation

It’s exciting to work with a range of companies who are thinking differently about the capability of hydrogen technology, and Luxfer has partnered on many successful conversion projects, including the UK’s first hydrogen train, HydroFLEX.

The beauty is that every conversion project is different, and we offer a bespoke design and manufacture service, featuring our G-Stor™ H2 cylinders.

Of course, converting existing vehicles means working within the constraints of a framework that needs to be adapted. Replacing systems based on a liquid fuel with ones that need to work on gaseous fuel has its inherent challenges. While liquid can be stored in any shape, the optimal shape for high pressure gas storage is still cylindrical.

Advantages of working with Luxfer on conversions includes:

- We can help our partners through cross fertilization of ideas. A rail company may never collaborate with a shipbuilder, but our engineers have delivered retrofits for both and, those connections and cross pollination can spark interesting and practical concepts.

- We support with regulation, derived from our decades of expertise in high pressure gas containment. For example, where directives may not exist, we can explore what applies in parallel markets and consider transferable norms that will deliver against safety requirements.

- Our customers reap the benefits of working with a company that has tried and tested experience and understands every component needed to make the optimum recommendations specific to their project. We are supporting SMEs with the hunger to drive this market, and we can help them realise their ambitions.

An important byproduct is that Luxfer benefits too. Putting our efforts into advancing the market for conversions drives innovation within our own business, helping to shaping our own technological developments.

For further information on Luxfer’s alternative fuel expertise visit: www.luxfercylinders.com/products/alternative-fuel